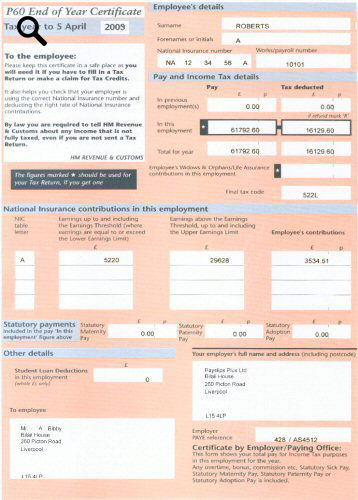

P60 End of Year Certificate Explained

Prior to 2019 a P60 was a document given at the end of each year from your current employer this is now referred to as an end of year statement. Manage your account 247.

What Is A P60 Form And Way To Get It Payslips Plus

The amount of your contributions should appear on your wage slip each time you are paid and on your P60 tax information each year.

. If the unfortunate scenario does. This means that you need to submit a yearly set of accounts to Companies House at the end of your accounting period. D Certificate of employment of the husband if he is working abroad.

Failure to deliver P60s on time may lead to an investigation by HMRC. When Should I Join the Workplace Pension Scheme. Some people will get more some less.

Every AA ISA comes automatically with a holding account where you can consolidate or split your existing savings before moving them to. B can compel S to deliver because B is willing to pay the price. The IRS cited several critical tax law changes that took place in 2021 and Jan 23 2022 If youre still awaiting a 2020 refund and used a Non-Filer tool to register for an Advance Child Tax Credit or stimulus payment last year enter as your Adjusted Gross Income the IRS advises.

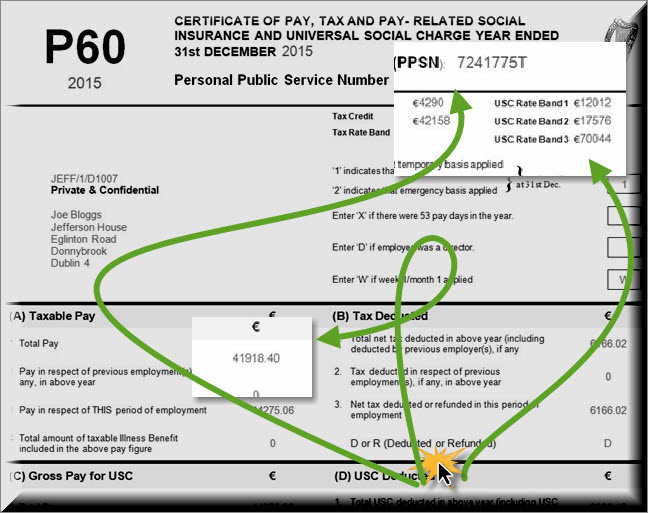

Both contain details of your pay as well as the tax youve paid to the revenue. Both documents are now available online on your Revenue account. From 2019 onwards you will no longer get a P60 at the end of the year.

The contract falls under the Statute of Frauds therefore unenforceable. The UKs independent authority set up to uphold information rights in the public interest promoting openness by public bodies and data privacy for individuals. If you think your payments are wrong speak to your employer straight away and ask them to sort it out.

Statute of Frauds inapplicable because the price is less than P500. Sometimes they end up line 16 with witholding. F Waiver from exemption on withholding tax of taxpayers whose total compensation income in a year does not exceed P6000000.

P60 Form is issued to tax payers at the end of the year. At the end of two-year period S refused to deliver the radio although B was willing to pay. If you are in a union they may provide advice and help about your pension scheme.

Your businesss year-end accounts should include the. E Waiver of exemptions of children by the husband in case wife is claiming the additional exemptions of the children. The object is movable oral contract is enforceable.

In accordance with the Companies Act 2006 and accounting standards details about your businesss finances need to be made accessible for the public. At the end of the fixed term well pay your money along with any interest to a tax-free holding account while you decide what to do next. The P60 is also a vital document needed when querying a tax code claiming a tax refund or completing a tax return as well as instances when our personal circumstances change.

You should never destroy your P60 form. Transfer out the full amount only no partial transfers.

P45 Vs P60 What S The Difference Revolut

Comments

Post a Comment